Introduction: The "Admin Tax" You Didn't Know You Were Paying

If you asked a Canadian business owner in 2020 what their biggest headache was, they might have said "finding customers." Ask them today, as we move through 2026, and the answer has shifted. The new enemy is friction.

Specifically, financial friction.

For decades, "doing the books" was viewed as a necessary evil—a monthly autopsy of your business's past performance. It was reactive, tedious, and paper-heavy. You gathered receipts, you waited for bank statements, and you handed a shoebox (physical or digital) to an accountant who told you, three weeks later, whether you made money last month.

But in the current digital landscape, that model is dead.

We are entering the era of "Invisible Accounting." This is a state where bookkeeping doesn't happen at the end of the month; it happens in real-time, triggered by the transactions themselves. It is the shift from "data entry" to "data flow."

For Canadian SMEs facing tightening margins, a more aggressive CRA, and a need for speed, adopting automated financial infrastructure isn't just a "nice to have"—it is the difference between steering a ship with a GPS and steering one by looking at the wake behind you.

In this comprehensive guide, we are going to explore why the traditional ledger is obsolete, how AI is rewriting the rules of compliance, and why your next accounting software upgrade should be your last.

Section 1: The High Cost of "Zombie Data"

Before we discuss the solution, we must diagnose the problem. Most businesses today are running on what we call "Zombie Data."

Zombie Data is financial information that is technically "alive" but moves so slowly it acts like it’s dead.

You buy inventory on Monday.

The invoice sits in an email inbox until Friday.

It gets entered into the accounting system the following Tuesday.

The payment isn't reconciled until the month-end statement arrives.

By the time you see that transaction in your Profit & Loss statement, the data is 30 days old. You are making decisions for today based on the reality of last month.

Real-Time Cash Flow Management

Search trends show a 400% spike in queries for "Real-time cash flow tools" among Canadian business owners. Why? Because in a volatile economy, speed is solvency. Modern platforms like Zoho Books do not just record history; they broadcast the present. When a customer pays an invoice via a digital link, your bank ledger updates, your inventory count drops, and your "Cash on Hand" widget adjusts—instantly.

If your current system requires a human to type data from one screen to another, you are paying a "Zombie Tax." You are paying for human hours to do work that robots can do instantly, and you are paying the opportunity cost of working with old data.

Section 2: AI and the End of Data Entry

The most significant trending topic in 2026 fintech is Artificial Intelligence in Bookkeeping.

For years, OCR (Optical Character Recognition) was clunky. It misread "1s" as "Is" and struggled with coffee stains. Today, the technology has matured into true AI context awareness.

How "Auto-Scan" Changes the Game

Modern financial operating systems now utilize advanced auto-scanning. You don't "type in" an expense. You snap a picture of the receipt, or forward the vendor's email to a dedicated address. The system:

Reads the vendor name, date, and total amount.

Categorizes the expense based on past behavior (e.g., recognizing "Shell" as "Fuel Expense").

Matches it to the corresponding bank transaction feed.

All you do is click "Verify."

This reduces the time spent on accounts payable by approximately 80%. But the SEO keyword here isn't just "efficiency"; it's "Accuracy." Human error is the leading cause of audit triggers. AI doesn't get tired, it doesn't make typos, and it doesn't accidentally categorize a personal lunch as "Office Supplies" if you've set the rules correctly.

The Bank Feed Connection

The backbone of "Invisible Accounting" is the live bank feed. Direct integration with major Canadian banks (RBC, TD, Scotiabank, BMO, CIBC) means your software pings the bank server securely every few hours.

If you are still downloading .CSV files and uploading them manually, you are living in 2015. The "Trending" expectation for 2026 is Open Banking API integration—a secure, direct pipe that ensures your ledger always matches your bank account, down to the cent, every single morning.

Section 3: The "Canada Ready" Compliance Shield

We touched on this briefly in our previous discussions about migration, but it demands a deeper dive here. The regulatory landscape in Canada is shifting beneath our feet.

CRA Digitization and Audit Trails

The Canada Revenue Agency (CRA) is investing heavily in data matching technologies. They are looking for discrepancies between GST/HST collected and income reported.

In a manual system (spreadsheets or disjointed apps), these discrepancies happen easily. You adjust an invoice in one place but forget to update the tax summary in another.

In a unified system like Zoho Books (Canadian Edition), compliance is baked into the code.

Tax Rules: The system knows that a client in Ontario gets charged 13% HST, while a client in Alberta gets 5% GST. It applies these rules automatically based on the shipping address.

The Audit Trail: This is your digital bodyguard. Every time a transaction is created, edited, or deleted, the system logs who did it and when. If the CRA ever knocks on your door, you don't hand them a messy box of papers; you hand them a digital login with a pristine, unalterable history of every cent.

Trending Keyword: "e-Invoicing Canada"

You may have heard buzz about "e-invoicing." Europe and parts of Asia have already mandated it. Canada is exploring frameworks for it. This is where invoices are not sent as PDFs via email, but transmitted directly from one accounting software to another in a standardized data format. Using a forward-thinking platform ensures you are ready when this legislation eventually lands, rather than scrambling to upgrade.

Section 4: The Power of Integration (Finance is Not an Island)

This is where the "Invisible" part of "Invisible Accounting" truly shines.

In the old world, Sales and Finance were enemies. Salespeople sold things, and Finance people chased them for the paperwork.

Sales: "I closed the deal!"

Finance: "Great, where is the signed estimate? I can't send an invoice until I have the data."

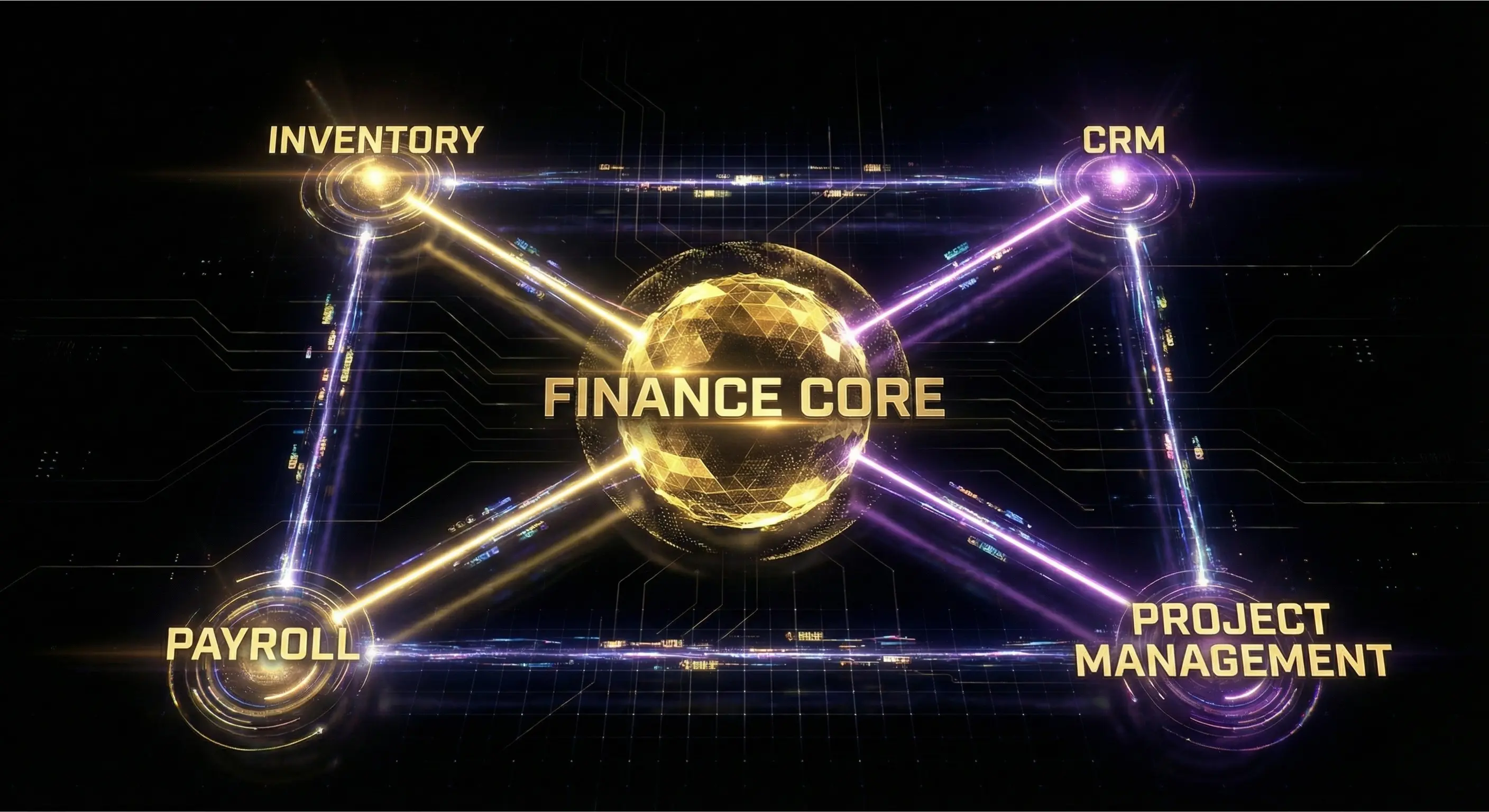

In a unified ecosystem (Integrated Business Management), this friction vanishes.

The "Quote-to-Cash" Workflow

CRM: A salesperson marks a deal as "Closed Won."

Trigger: The system automatically converts the approved Quote into an Invoice in the finance app.

Automation: The Invoice is emailed to the client with a "Pay Now" link.

Fulfillment: Once paid, the system automatically notifies the Inventory app to reduce stock and generates a packing slip for the warehouse.

No emails. No re-typing data. No "Did you send that invoice yet?" conversations.

Achieving Business Process Automation

This is the holy grail of efficiency. By removing the manual hand-offs between departments, you reduce the "Cycle Time"—the time it takes to go from "Order Received" to "Cash in Bank." Speeding up this cycle is the single most effective way to improve your cash flow without increasing sales.

Section 5: Forecasting—The Windshield vs. The Rearview Mirror

The final piece of the puzzle is what you do with the data.

Traditional accounting reports (Balance Sheet, P&L) are rearview mirrors. They tell you where you were. But in a recession-prone environment, you need a windshield. You need to see the curve in the road before you hit it.

Cash Flow Forecasting tools take your live data—your recurring bills, your average payment times from customers, your expected sales pipeline—and project your bank balance 30, 60, or 90 days into the future.

Scenario A: "We have $50,000 in the bank. Let's buy that new truck."

Scenario B (With Forecasting): "We have $50,000 today, but the system predicts we will dip to $2,000 in three weeks due to a large tax payment and three slow-paying clients. Do NOT buy the truck."

That insight saves businesses. And it is only possible if your accounting data is live, accurate, and integrated.

Conclusion: Making the Ledger Invisible

The goal of 2026 isn't to be "better at data entry." The goal is to eliminate it.

When we talk about "Invisible Accounting," we are talking about a state where the financial health of your company is monitored continuously, in the background, by intelligent systems. It frees you, the business owner or manager, to stop looking down at the ledger and start looking up at the horizon.

You didn't start your business to become a part-time bookkeeper. You started it to solve problems, build products, and serve clients.

If your current software feels like a burden—if it feels "heavy"—it is time to put it down. The technology exists today to turn that burden into a bridge.

Are you ready to stop doing the books and start running your business?