In today's fast-paced healthcare industry, efficient payroll management is critical for the smooth functioning of any medical practice. Clinics, hospitals, and healthcare providers face numerous challenges, including compliance with complex regulations, managing a diverse workforce, and ensuring that everyone—from doctors and nurses to administrative staff—is paid accurately and on time. That’s where clinic payroll services come into play.

These specialized services are designed to handle the unique needs of healthcare providers, ensuring that clinics can focus on what they do best—providing quality patient care—without worrying about payroll issues. In this article, we'll explore what clinic payroll services are, why they're essential, and how they can benefit your healthcare practice.

What Are Clinic Payroll Services?

At its core, payroll is about calculating and distributing employee wages. However, for clinics and other healthcare institutions, payroll management is much more complex than in many other industries. Clinic payroll services refer to specialized payroll processing that caters to the healthcare sector's unique needs, including regulatory compliance, benefits management, and employee classification.

Clinic payroll services can be offered by third-party providers or managed in-house with the help of sophisticated software. These services typically include:

- Payroll calculation: Accurate computation of wages, overtime, bonuses, and deductions based on hours worked and contracts.

- Tax filing and compliance: Handling tax withholdings, deductions, and the submission of payroll taxes to government authorities.

- Benefits administration: Managing healthcare benefits, pensions, and other employee benefits.

- Timekeeping and attendance tracking: Ensuring accurate tracking of employee hours to ensure compliance with labor laws and fair payment.

- Direct deposit management: Setting up and managing employee payments through direct deposit or other preferred methods.

- Compliance with healthcare industry standards: Ensuring the clinic adheres to labor laws, tax laws, and healthcare regulations.

Why Is Payroll So Critical for Clinics?

Payroll might seem like a standard business function, but it's particularly significant in a healthcare setting for several reasons:

1. Staff Morale and Retention

In the healthcare industry, employee satisfaction is vital. Medical professionals work long hours and face high-pressure situations daily. Timely, accurate payroll is crucial to maintaining staff morale. An error in paycheck amounts, delays in payments, or missed deductions can lead to frustration, affecting employee retention. A well-managed payroll service ensures that all staff members, from top-tier doctors to support staff, receive their wages accurately and on time, reducing stress and turnover rates.

2. Legal Compliance

Healthcare is one of the most regulated industries globally, especially when it comes to labor laws, taxes, and employee benefits. Failure to comply with these laws can result in hefty fines, legal action, and damage to your clinic’s reputation. Clinic payroll services help ensure that you comply with local, state, and federal laws, keeping you free from legal pitfalls and penalties.

3. Complex Workforce Structure

Clinics and hospitals typically employ a diverse workforce. You may have full-time doctors, part-time nurses, administrative personnel, and contract workers, all with varying pay structures and benefits. Managing such a complex workforce through generic payroll systems can lead to errors and inefficiencies. Clinic payroll services are tailored to handle this complexity, ensuring every employee's payroll is processed according to their specific contract and agreement.

4. Time Savings

Manually processing payroll can be incredibly time-consuming, especially when it involves compliance checks and tracking of employee hours. Clinic payroll services automate much of this work, freeing up time for your administrative staff to focus on more important tasks, such as improving patient care and managing clinic operations.

The Benefits of Outsourcing Clinic Payroll Services

If you're running a clinic or healthcare practice, you might wonder whether you should handle payroll internally or outsource it to a professional payroll service provider. While both options have their merits, outsourcing payroll offers several distinct advantages:

1. Cost Efficiency

Although outsourcing clinic payroll services requires an upfront investment, it can save you money in the long run. By reducing administrative overhead and minimizing errors that can lead to fines, outsourcing can prove to be a cost-effective option. Plus, third-party payroll providers typically offer packages tailored to your clinic's size and needs, allowing you to pay only for the services you require.

2. Enhanced Accuracy

Payroll errors can be costly. Overpayments, underpayments, or tax-related mistakes can lead to employee dissatisfaction or legal issues. Payroll service providers specialize in accurate calculations, ensuring compliance with tax laws and other regulations. Most payroll services use advanced software that reduces the risk of human error, giving you peace of mind that your clinic’s payroll is handled correctly.

3. Regulatory Compliance

Keeping up with changing payroll laws and tax codes can be overwhelming. With healthcare-specific regulations in place—like wage and hour laws, tax exemptions for medical professionals, and state-specific requirements—staying compliant is no easy task. By outsourcing your clinic's payroll, you ensure that the professionals handling your payroll stay up to date on the latest regulations, preventing legal complications.

4. Data Security

Clinic payroll involves handling sensitive information, including employees’ personal and financial data. Data breaches in the healthcare industry can have disastrous consequences, both in terms of financial loss and reputational damage. Reputable payroll providers invest heavily in cybersecurity measures to ensure your clinic's payroll data is protected.

5. Focus on Core Activities

Managing payroll internally means you need to dedicate time and resources to non-core activities, which could be better spent on patient care or business growth. By outsourcing payroll, you free up your management team to focus on what they do best—running a successful healthcare facility.

Common Features of Clinic Payroll Software

If you decide to keep payroll in-house, clinic payroll software can be a valuable tool. Here are some features you should look for in a payroll system designed for healthcare facilities:

1. Time and Attendance Tracking

An integrated timekeeping system allows you to track employee hours efficiently, ensuring everyone is paid correctly for their time worked. This is especially important for clinics with a rotating staff or varying shifts.

2. Compliance Management

Good payroll software will automatically update according to the latest healthcare laws and tax regulations, ensuring you remain compliant without manual intervention.

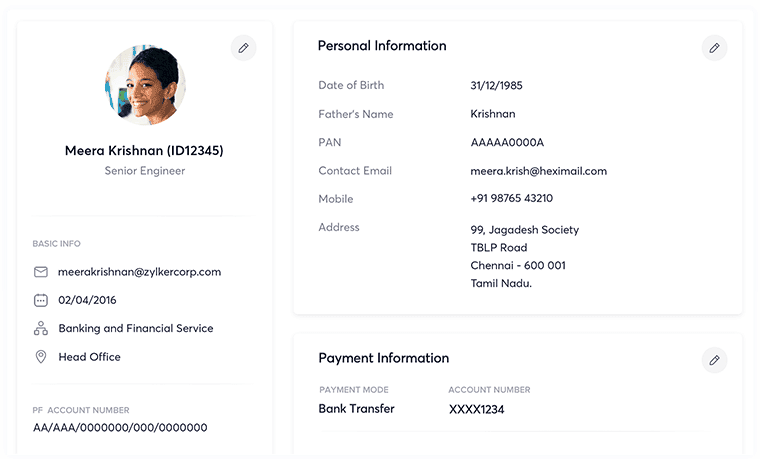

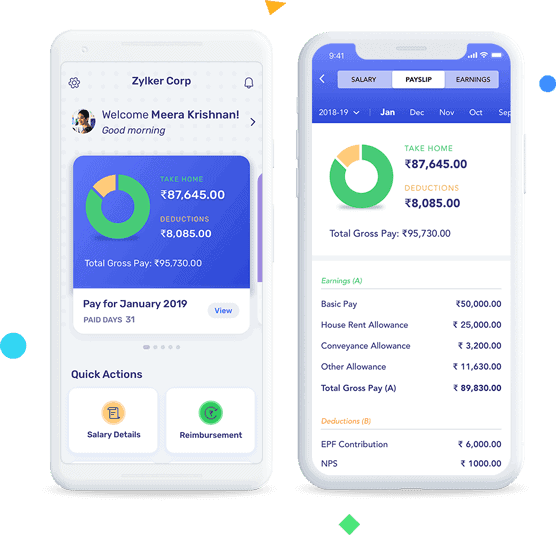

3. Employee Self-Service

With an employee self-service portal, staff can view their pay stubs, check their benefits, and update their personal information, reducing the administrative burden on HR.

4. Tax Filing

Ensure that the software automatically calculates, files, and submits payroll taxes, saving you the headache of manual tax filing and reducing the risk of errors.

5. Custom Reporting

Every clinic has different reporting needs. Whether it’s tracking overtime, generating tax reports, or monitoring payroll expenses, custom reporting features allow you to access the information you need quickly and easily.

How to Choose the Right Clinic Payroll Service

Not all clinic payroll services are created equal, and choosing the right one for your practice is crucial. Here are some factors to consider when selecting a payroll service provider:

1. Industry Experience

Look for a provider with specific experience in the healthcare industry. They’ll be familiar with the unique regulations and challenges that clinics face, reducing the likelihood of costly mistakes.

2. Flexibility

Your clinic’s payroll needs will change as your practice grows or shrinks. Choose a payroll provider that can scale their services up or down based on your clinic's size and needs.

3. Customer Support

When dealing with payroll issues, you need fast and reliable customer service. Look for a provider that offers dedicated support teams familiar with your clinic's needs.

4. Integration Capabilities

If you use other management software, such as electronic health records (EHR) or practice management systems, ensure that the payroll service can integrate with them seamlessly.

Conclusion

Clinic payroll services are a vital component of managing a successful healthcare facility. Whether you choose to outsource or manage payroll in-house using specialized software, the key is to ensure accuracy, compliance, and employee satisfaction. By streamlining your clinic’s payroll processes, you can focus on providing excellent patient care while ensuring your staff is paid fairly and on time.

Investing in clinic payroll services is not just a matter of convenience—it’s a strategic decision that can save time, reduce errors, and improve the overall efficiency of your healthcare practice.