In Canada's economic scene, small businesses shine as the powerhouse, constituting a whopping 98% of all employer businesses and standing strong even during the global pandemic. For those in this robust group, competition is intense, requiring steadfast dedication to stay ahead. In the midst of these challenges, the message is clear—business owners should spend more time advancing their ventures and less time on the hefty tasks of accounting and bookkeeping. This is where the right software becomes a key partner, automating processes and freeing up time for essential business strategies.

This article not only recognizes the significance of efficient accounting systems but also unveils the top accounting software options specifically tailored for small businesses in Canada. We will navigate the nuanced landscape of accounting software, meticulously considering factors such as compliance with Canadian regulations, scalability, user-friendliness, integration capabilities, and reliable customer support. Additionally, the fundamental choice between desktop and cloud-based solutions will also be explored, weighing the pros and cons to aid in your decision-making process.

Things to Consider When Choosing Small Business Accounting Software (in Canada)

Selecting the right accounting software is a critical decision that can significantly impact your business operations. Before delving into the specific software options, let's explore the key factors to consider when making this crucial choice.

Compliance with Canadian Regulations: Canadian businesses operate under specific financial regulations. Ensure that the accounting software you choose complies with the Canadian tax code and other relevant regulations.

Scalability: Your business may be small now, but it's essential to choose software that can scale as your business grows. Look for solutions that offer scalability and flexibility to adapt to your evolving needs.

User-Friendly Interface: The software's user interface should be intuitive and user-friendly, especially for those without a strong accounting background. This ensures that your team can easily navigate and utilize the software efficiently.

Integration Capabilities: Consider the software's compatibility with other tools and applications your business uses. Integration with banking, invoicing, and payroll systems can streamline your financial processes.

Customer Support: Reliable customer support is crucial. Look for software providers that offer excellent customer service, including timely responses to queries and accessible support channels.

Accounting Software Category: Desktop VS Cloud

The choice between desktop and cloud-based accounting software is a fundamental decision that businesses need to make. Each option has its pros and cons, and the decision often depends on the specific needs and preferences of the business.

Desktop Accounting Software

Desktop accounting software refers to accounting applications that are installed and run on a local computer rather than being accessed through a web browser. Here are some key characteristics of desktop accounting software:

Installation: Desktop accounting software requires installation on a computer's hard drive. Users typically purchase a license or subscription and download the software onto their desktop or laptop.

Offline Access: Once installed, desktop accounting software can usually be used without an internet connection. Users can access their financial data and perform various accounting tasks even when not connected to the internet.

Data Security: Since the data is stored locally on the user's computer, there may be a perception of greater control and security. Users are responsible for backing up their data to prevent loss in case of computer issues.

Features: Desktop accounting software often comes with a comprehensive set of features for managing finances, such as invoicing, expense tracking, payroll processing, and financial reporting.

Customization: Users may have more flexibility to customize the software based on their specific needs. This can include tailoring reports, setting up specific charts of accounts, and configuring preferences.

One-time Purchase or Subscription: Users may purchase desktop accounting software with a one-time payment or opt for a subscription-based model, where they pay regularly to receive updates and support.

Upgrades: Users are responsible for manually upgrading the software to the latest version. This may involve purchasing new versions or updating through the software provider's website.

Cloud Accounting Software

Cloud accounting software, also known as online accounting software, is a type of accounting software that operates on internet servers, allowing users to access their financial data and perform accounting tasks through a web browser. Here are key features and characteristics of cloud accounting software:

Accessibility: Cloud accounting software is accessible from any device with an internet connection. Users can log in securely from a web browser, making it convenient for businesses with multiple locations or individuals who need remote access.

Real-time Collaboration: One of the significant advantages of cloud accounting is real-time collaboration. Multiple users, such as accountants, business owners, and financial advisors, can work on the same set of financial data simultaneously, promoting collaboration and efficiency.

Automatic Updates: Cloud accounting software is typically maintained and updated by the service provider. Users don't need to manually install updates, ensuring that they always have access to the latest features and security patches.

Data Security: Cloud accounting services invest heavily in security measures to protect user data. This includes encryption, firewalls, and other advanced security protocols. Regular backups are also performed to prevent data loss.

Scalability: Cloud accounting solutions are often scalable, allowing businesses to adjust their subscription plans based on their needs. This is particularly beneficial for growing businesses that may need to accommodate an increasing volume of transactions.

Subscription-based Model: Cloud accounting software is often offered through a subscription-based model, where users pay a monthly or annual fee for access to the service. This model may include additional benefits such as customer support and regular updates.

Integration: Cloud accounting software often integrates seamlessly with other cloud-based business tools and applications. This can include integrations with payment processors, e-commerce platforms, and more.

Automatic Data Synchronization: Since the data is stored in the cloud, changes made by one user are instantly reflected for all authorized users. This ensures that everyone has access to the most up-to-date financial information.

It's important to note that the landscape of accounting software is evolving, and cloud-based accounting solutions are becoming increasingly popular. Cloud-based alternatives offer advantages such as accessibility from any device with an internet connection, automatic updates, and collaborative features. Users often choose between desktop and cloud-based solutions based on their specific preferences, business needs, and comfort with technology.

Best Accounting Software for Small Business in Canada (2024 List)

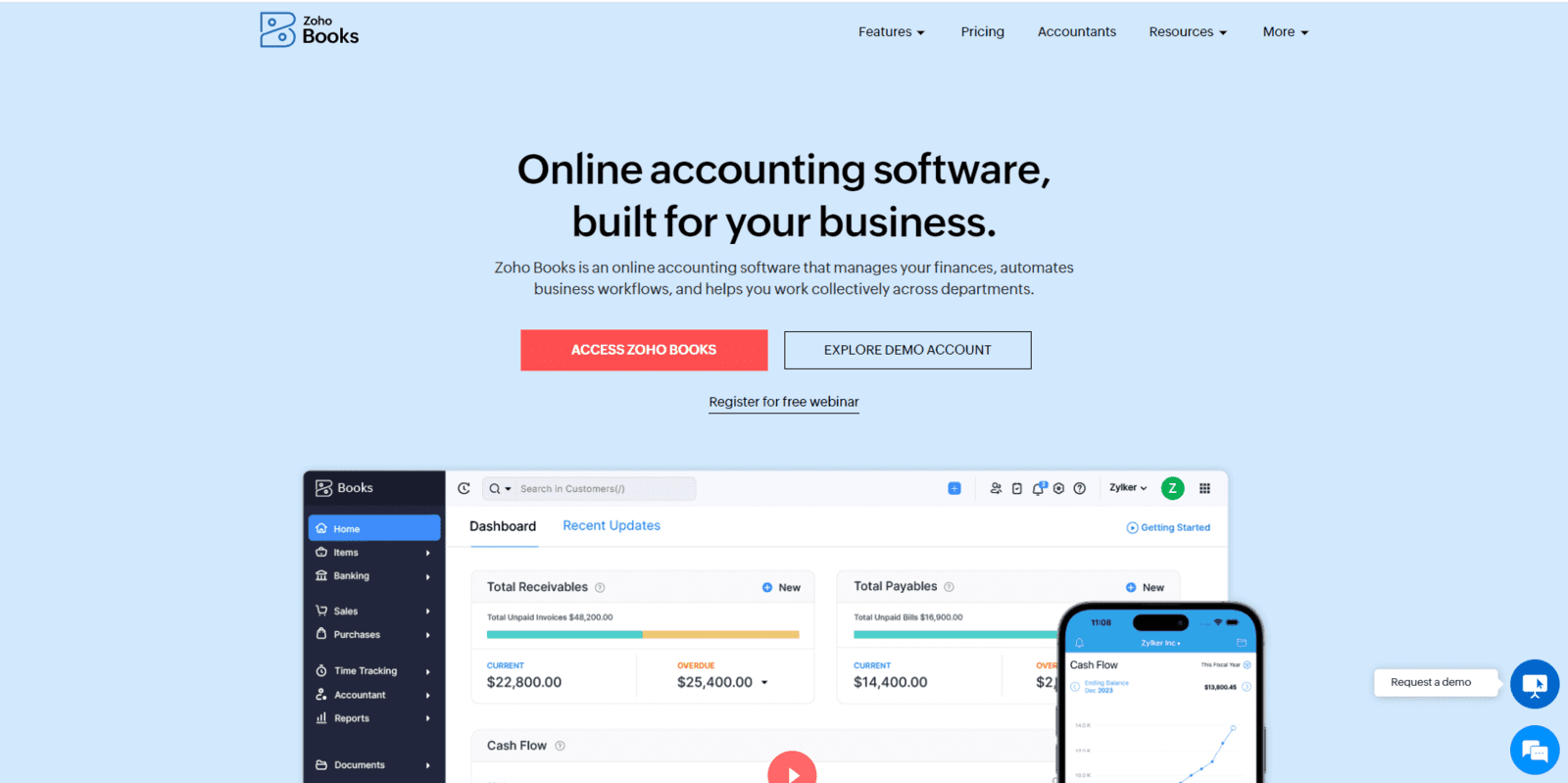

Zoho Books

Zoho Books is an online accounting software designed for small businesses to manage their finances and streamline their accounting processes. Developed by Zoho Corporation, Zoho Books offers a range of features to help businesses with tasks such as invoicing, expense tracking, financial reporting, and more. Zoho Books offers different subscription plans to cater to the needs of various businesses, and it is known for its user-friendly interface and affordable pricing. It has gained popularity among small businesses seeking an efficient and comprehensive accounting solution.

Feature:

- Cloud-Based Access: Zoho Books operates as a cloud-based solution, allowing users to access their financial data from any device with an internet connection. This provides flexibility and facilitates collaboration among team members and accountants.

- Invoicing: Users can create and send professional invoices to clients, customize invoice templates, set up recurring invoices, and track payment status. Zoho Books also supports online payment gateways, making it convenient for clients to make payments.

- Expense Tracking: Zoho Books allows users to track and categorize expenses, making it easier to manage and monitor business spending. Users can connect bank accounts and credit cards to automatically import transactions.

- Bank Reconciliation: The software facilitates bank reconciliation by matching transactions from connected bank accounts with entries in the accounting records. This helps ensure accuracy and consistency in financial data.

- Financial Reporting: Zoho Books provides a variety of customizable financial reports, including profit and loss statements, balance sheets, and cash flow statements. These reports offer insights into the financial health of the business.

- Inventory Management: For businesses dealing with inventory, Zoho Books includes features for tracking stock levels, managing purchase orders, and generating reports related to inventory.

- Multi-Currency Support: Zoho Books supports multiple currencies, making it suitable for businesses engaged in international transactions. Users can invoice and track expenses in different currencies.

- Integration with Zoho Suite: Zoho Books seamlessly integrates with other applications in the Zoho Suite, such as Zoho CRM and Zoho Inventory. This integration allows for a more comprehensive business management experience.

- Collaboration: Multiple users can collaborate on Zoho Books, each with different access levels. This is beneficial for businesses that involve various team members and external stakeholders.Automation: Zoho Books includes automation features for recurring tasks, payment reminders, and other processes, helping businesses save time and reduce manual effort.

Pros:

- Offer lots of accounting and bookkeeping features

- User-friendly interface with a clean design.

- Including automation features for recurring tasks, payment reminders, and other processes, helping businesses save time and reduce manual effort.

Cons:

- Some advanced features may require higher-tier plans.

- Users new to accounting software may experience a learning curve, especially if they are not familiar with cloud-based platforms.

Cost:

- Offers Free plan

- Standard at $15 per month

- Professional at $30 per month

- Premium at $40 per month

- Elite at $165 per month

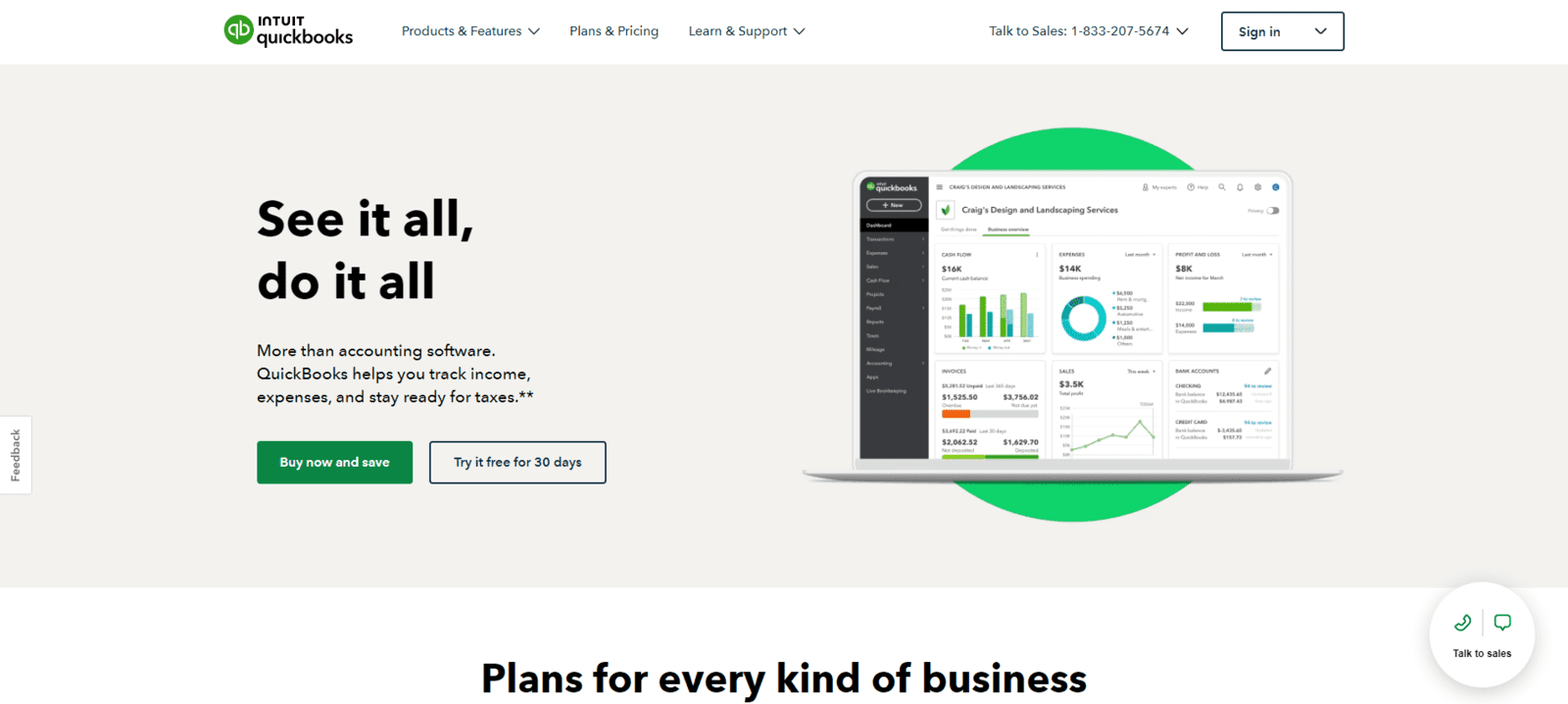

QuickBooks Online

QuickBooks Online is suitable for businesses of various sizes and industries, offering different subscription plans to accommodate different needs. It has become a popular choice for its user-friendly interface, accessibility, and comprehensive set of features for managing financial tasks efficiently.

Feature:

- Invoicing: Create professional invoices and track payments.

- Expense tracking: Capture and categorize business expenses.

- Financial reporting: Generate customizable reports for insights.

- Payroll management (additional feature): Streamline payroll processes.

Pros:

- User-friendly interface.

- Scalable for growing businesses.

- Integration capabilities with third-party apps.

Cons:

- Subscription costs may be higher for advanced features.

Cost:

- 30 days free trial

- EasyStart at $30 per month

- Essentials at $60 per month

- Plus at $90 per month

- Advanced at $200 per month

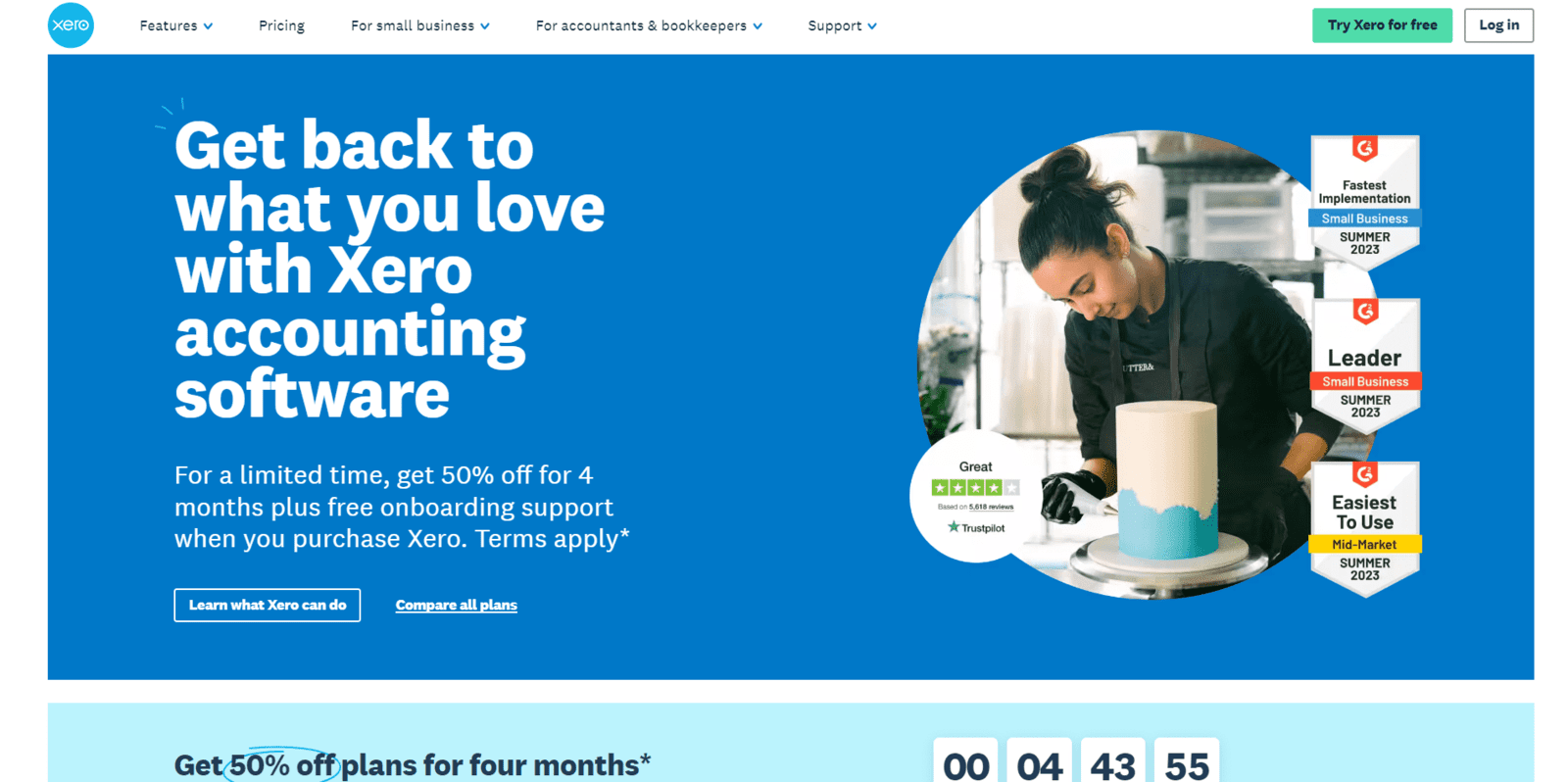

Xero:

Xero is an online accounting software platform designed for small and medium-sized businesses. It provides a cloud-based solution for managing various aspects of financial operations, including invoicing, expense tracking, payroll, bank reconciliation, and financial reporting.

Feature:

- Payroll: Xero offers payroll features to help businesses manage employee salaries, taxes, and compliance

- Expense tracking: Manage business expenses seamlessly

- Collaboration features: Facilitate teamwork on financial tasks

- Invoicing: Create and send invoices efficiently

Pros:

- Collaboration features enhance team efficiency

- Cloud-based accessibility for flexibility

- User-Friendly Interface

- Integration Options

Cons:

- While Xero offers various subscription plans, some users may find the cost to be relatively higher compared to other accounting software options.

- In certain areas, customization options may be limited compared to other accounting software platforms.

- While Xero offers payroll functionality, there might be more robust payroll solutions available for larger businesses with complex payroll needs.

Cost:

- Starter at $20 per month

- Standard at $48 per month

- Premium at $67 per month

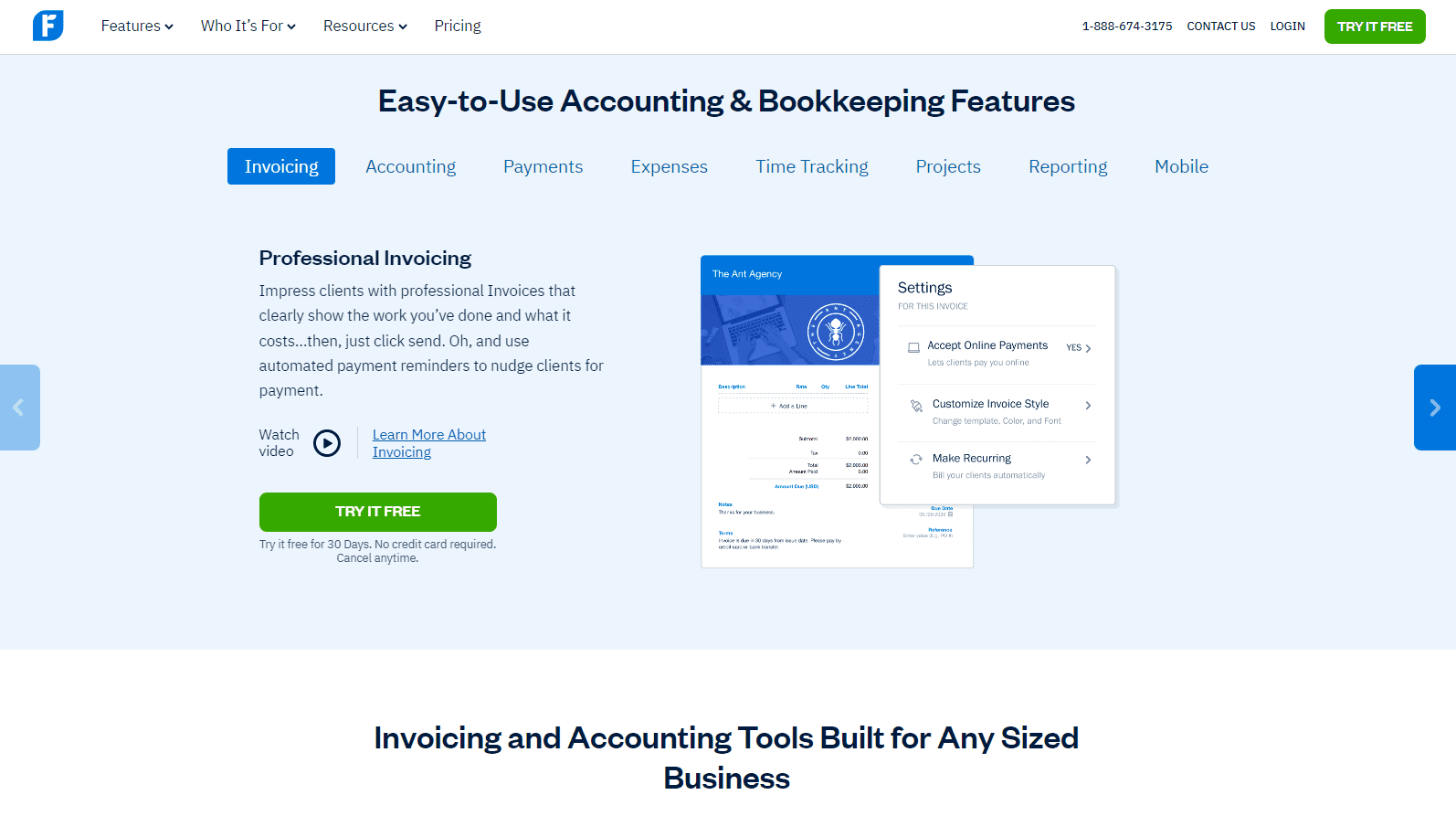

FreshBooks

FreshBooks is an online accounting software and invoicing platform designed for small businesses, freelancers, and self-employed professionals. It provides tools to help users manage their finances, track expenses, send invoices, and handle various accounting tasks.

Feature:

- Invoicing: Create professional invoices with ease.

- Expense tracking: Track and categorize business expenses.

- Time tracking: Monitor billable hours for projects.

- Project management: Collaborate and manage projects.

Pros:

- User-friendly interface, ideal for beginners.

- Efficient for small businesses with project needs.

Cons:

- Limited advanced accounting features compared to some competitors.

Cost:

- Lite at $22 per month

- Plus at $35 per month

- Premium at $60 per month

Conclusion

In conclusion, choosing the right accounting software is a crucial step towards ensuring the financial health of your small business in Canada. Consider the specific needs of your business, compliance with Canadian regulations, and the scalability of the chosen solution. Whether opting for cloud-based solutions like QuickBooks Online, Zoho Books, Xreo, or Fresh Books, make an informed decision that aligns with your business goals. The right accounting software can streamline your financial processes, enhance efficiency, and contribute to the overall success of your small business in 2024 and beyond.

Bickert Management(BMI): Your Partner for Accounting Software Excellence

As a premium Zoho partner, BMI brings a wealth of expertise to the table, specifically tailored to assist businesses in implementing, setting up, and optimizing their accounting software. Whether you're considering Zoho Books or any other accounting software from our curated list, BMI stands as your dedicated partner to ensure a seamless transition and ongoing support.

In partnering with BMI, you're not just getting an accounting software solution; you're gaining a dedicated partner committed to your business's financial success. Contact us today to explore how BMI can elevate your accounting processes to new heights.